Protect Your Structure: Trust Foundations for Durability

Reinforce Your Tradition With Expert Count On Foundation Solutions

Expert trust fund structure solutions use a durable framework that can secure your possessions and guarantee your desires are carried out exactly as meant. As we dive into the subtleties of trust foundation remedies, we discover the crucial aspects that can strengthen your heritage and give a long-term influence for generations to come.

Advantages of Depend On Foundation Solutions

Depend on structure solutions supply a robust framework for safeguarding assets and ensuring long-lasting monetary protection for people and organizations alike. One of the primary advantages of count on structure remedies is property defense.

Via trust funds, people can detail exactly how their assets should be taken care of and distributed upon their death. Counts on also supply privacy benefits, as possessions held within a trust are not subject to probate, which is a public and usually extensive lawful process.

Kinds of Depends On for Legacy Planning

When thinking about tradition preparation, a crucial element entails checking out different sorts of legal instruments created to maintain and disperse properties properly. One typical sort of depend on used in heritage preparation is a revocable living depend on. This depend on enables people to keep control over their properties throughout their life time while making certain a smooth shift of these properties to recipients upon their passing away, staying clear of the probate process and giving privacy to the family members.

Philanthropic depends on are additionally popular for individuals looking to support a reason while maintaining a stream of income for themselves or their recipients. Special demands counts on are important for individuals with handicaps to guarantee they obtain required treatment and assistance without endangering federal government benefits.

Recognizing the various kinds of counts on offered for heritage planning is essential in developing an extensive strategy that aligns with private goals and concerns.

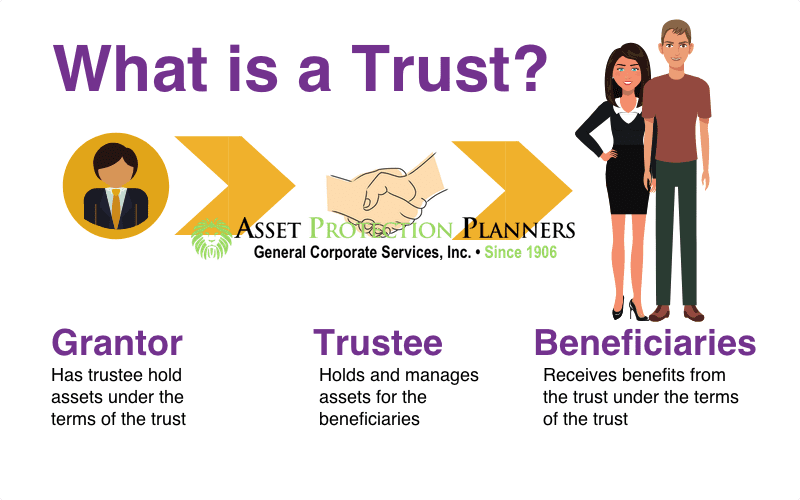

Picking the Right Trustee

In the realm of legacy preparation, a critical facet that demands careful consideration is the option of an appropriate individual to fulfill the critical function of trustee. Selecting the ideal trustee is a decision that can dramatically influence the effective implementation of a depend on and the satisfaction of the grantor's dreams. When choosing a trustee, it is necessary to read this article focus on high qualities such as dependability, monetary acumen, honesty, and a dedication to acting in the finest rate of interests of the recipients.

Ideally, the picked trustee ought to have a strong understanding of economic matters, be qualified of making audio financial investment choices, and have the capability to navigate intricate legal and tax obligation needs. By carefully taking into consideration these factors and picking a trustee that straightens with the worths and goals of the trust fund, you can aid ensure the lasting success and conservation of your legacy.

Tax Ramifications and Advantages

Taking into consideration the financial landscape surrounding count on structures and estate preparation, it is paramount to look into the complex world of tax obligation effects and advantages - trust foundations. When developing a count on, comprehending the tax effects is crucial for maximizing the advantages and decreasing prospective liabilities. Counts on offer various tax obligation advantages relying on their structure and objective, such as reducing estate tax obligations, revenue tax obligations, and present taxes

One considerable advantage of certain count on frameworks is the ability to transfer possessions to recipients with minimized tax obligation effects. For instance, unalterable trusts go to these guys can remove properties from the grantor's estate, potentially reducing estate tax responsibility. Additionally, some depends on enable revenue to be dispersed to beneficiaries, that may remain in lower tax brackets, resulting in total tax cost savings for the family members.

However, it is necessary to note that tax laws are intricate and subject to transform, stressing the necessity of speaking with tax obligation experts and estate preparation professionals to make sure compliance and maximize the tax advantages of trust fund foundations. Properly browsing the tax obligation ramifications of trust funds can lead to substantial financial savings and a much more effective transfer of riches to future generations.

Steps to Establishing a Trust Fund

The first action in developing a trust fund is to plainly specify the purpose of the trust and the properties that will certainly be included. Next, it is vital to pick the type of count on that best lines up with your objectives, whether it be a revocable trust, irreversible trust fund, or living trust.

Final Thought

In conclusion, establishing a count on structure can offer countless advantages for heritage planning, including possession protection, control over distribution, and tax obligation benefits. By choosing the suitable kind of trust and trustee, individuals can guard their assets and guarantee their dreams are performed according to their wishes. Recognizing the tax ramifications and taking the required actions to develop a trust fund can help enhance your tradition for future generations.